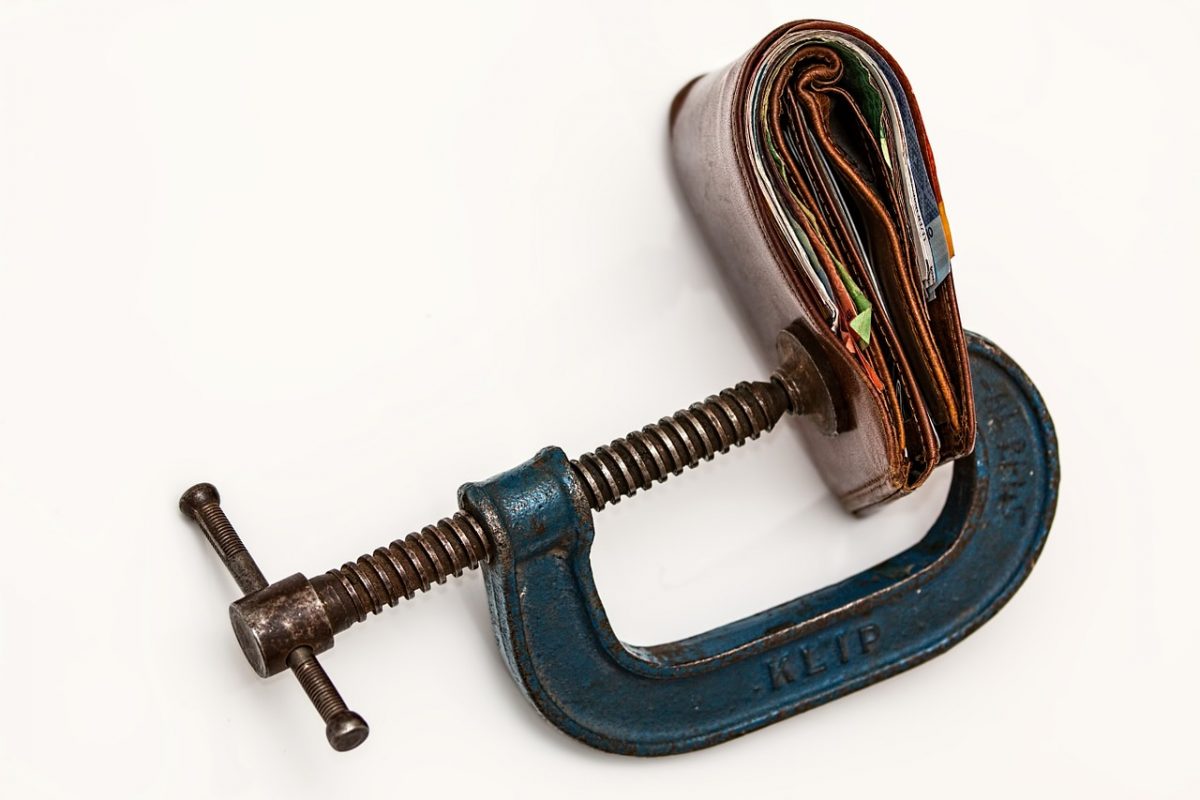

When most business prospects look depressed and down in the dumps, there is one side business to get into that you could count on: appealing commercial businesses property taxes. Appeal is urgent otherwise that property tax does not change!

Just like residential properties, if one doesn’t appeal nothing changes. Unlike residential real estate, which is based on a Market Value Method approach (and experts tell us 40%+ are over-assessed), business properties are assessed using an Income Method Approach. Your contingency fees can be huge.

So, if a multi-family apartment has fewer renters paying their rent, a strip mall with few tenants, a gym, bar or restaurant with fewer customer, etc, therefore because of less income for a given business, appeal is urgent! Few business owners are familiar with this appeal process and unless you’re a huge business, there is little competition and few will be knocking on their doors as Property Tax Consultants. Many will be caught by their short hairs when they don’t appeal.

Unless this pandemic and the coming depression comes to an end, there will be an opportunity to help those caught in this dilemma. As a needed work from home business, one can reach out to those businesses that are economically suffering and ease their financial burden. It’s a win, win for everyone and you’re rewarded with high contingency commissions for your service.

Also, consider the residential area. Property taxes are ever increasing and localities are of a lock-down mentality when it comes to conducting an expensive blanket reappraisal for their neighborhoods. It’s easier and cheaper to roll-over the previous years’ assessment. Judging from overall lagging assessment practices, you’ll find more than enough over-assessed residential homes to appeal considering the 40%+ over-assessment rate.

Homeowners and businesses complain about increases in their property taxes. Previous assessments are rolled over and few contest when properties are overvalued.

If a property owner, a business or owner of rental property believes the new assessment does not represent fair market value, they need to appeal. The process of equalizing values of similar properties is similar to buying a used car. Certain adjustments are made for the appearance of the car, mileage, features the car has that the comparable doesn’t, wear and tear of the tires, ect.

Municipalities and sometimes counties undergo massive property tax reassessments. Updated property tax assessment brokers bid for the job and the low bid wins. There’s a rush to judgment and mistakes happen.

For the most part, most property owners believe assessment s are an accurate representation of the fair market value of their property and do not take any action. It’s like believing the used car salesman’s price tag without doing your own comparison if you’re in the market for buying a used car. Only by doing some sort of due diligence and making your own comparisons do you know if the price is legitimate.

With businesses, because of the corona virus event that acts like a catalyst knocking down valuations, there will be many obvious cases for reassessment. Again, property tax consultants are few and property tax system requires appeal otherwise change will not show its face. As far as the methods for determining value and furnishing reliable evidence to support those conclusions, that’s what the course is all about.

MUST-READ Property Tax Appeal Course for 2020!Appeal For Yourself And/OrEarn High Contingency Fees From Your Clients

Go to http://propertytaxconsult.com for the full story and complete your Property Tax Appeal Course for Residential And Business Property Tax Appeals