Why Are My Property Taxes So High?

Why Are My Property Taxes So High?

Taxes on our residential or commercial property may not be in line with actual market value. Neighborhoods differ, locations differ, fundamental neighborhood differences may not have been accounted for and dozesn of other factors may not have been taken into consideration.

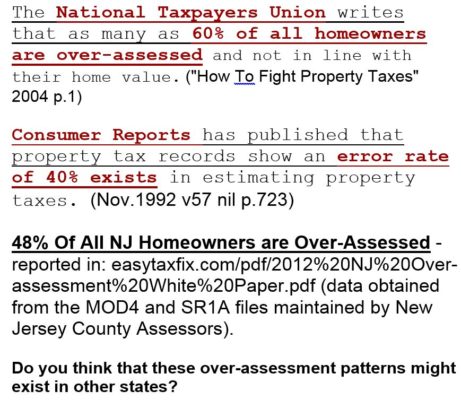

Taking into consideration there is a 30% to 60% mistake rate, it’s a good idea to take a good look at comparable sold homes within the time frame of your property tax assessment. You will want to make some fundamental adjustment calculations on the differences that set your home apart from the comparable.

The best step is to secure an authoritative manual the will guide you step by step through this 5th grade arithmetic evaluation process. If you have a case that is worth negotiating, it will be worth thousand of dollars to you in time.

Categories of Compatibility:

- similar neighborhood

- total square feet of living space

- number of rooms, bedrooms, baths

- sold preferably within 4 months

- sales price within general market price of your home

- sales or financing concessions

- location

- quality of construction

- style of house

- age of house

- condition

- square footage

- property site and view

- functional utility (deficiencies or overbuilt features)

- number of garages

- swimming pool, fireplace(s), remodeled kitchen, kitchen equipment, etc.

- storm windows or replacement window or thermopane windows

- basement i.e. finished, unfinished or none

- deck, patio, porch, etc.

- landscaping

Reasons For Property Tax Mistakes

With the real estate property tax, it can be a problem of sloppy mathematics as well as human mistake. The town’s obligation to get an accurate value is in the cross hairs and the towns tax assessor rarely does the actual examining. It’s left up to others to get that initial assessment.

A town will work with an evaluation company to do a mass evaluation on an affordable bid bases. The evaluation business that wins the bid needs to pay those people that are going from door to door. The time and perspective allotted to unmask the true market value to the building they are evaluating is compromised therefore errors creep in. Excessive time by the mass appraisal employee is cash lost for the winning prospective mass appraisal broker.

A town will work with an evaluation company to do a mass evaluation on an affordable bid bases. The evaluation business that wins the bid needs to pay those people that are going from door to door. The time and perspective allotted to unmask the true market value to the building they are evaluating is compromised therefore errors creep in. Excessive time by the mass appraisal employee is cash lost for the winning prospective mass appraisal broker.

There is just a minimum quantity of time that can be assigned to each home valuation. It is not unusual for previous assessments to be carried over and also given an adjustment. Often times those doing the analyzing are not skilled at their job. The appraisal company winning the affordable bid needs and wants to see a rewarding return on their winning bid. They are going to push their team to get as much work performed in the fastest period of time. Due to this, accuracy is given up.