You love your house, but you suspect that property tax bill might be over the top. Can’t vote to a lower property tax, that’s never on the ballot. You’re not alone, many feel that way but where do you start? How do you go about that lowering task?

Fortunately, we provide free training that will map out the steps you need to accomplish that task. You’ll know if you have a case worth pursuing. It’s an easy guide map that anyone can use. PLUS, we give you access to comparable analysis worksheets as well as free access to the best comparable sold home listings near your home and in your municipality.

You might ask, why do we provide this lower property tax free training? We want to help the many who are victims of over-assessment and don’t quite know how the property tax system works. Our company serves two fronts.

- Homeowners who suspect they don’t have a property tax appeal case and when they have confirmed that they do have a worthwhile appeal case to pursue, will have access to Real Estate Valuation & Property Tax Appeal Training Course.

- Entrepreneurs who need to be well qualified to work as a property tax consultant need a professional training. Our Real Estate Valuation & Property Tax Appeal Training Course services both residential and the highly lucrative commercial business property tax appeals business. It’s an under-the-radar niche, no licensing is required except for the state of Texas and is financially rewarding as a work from home side business.

Why It Is Reasonable To Question Your Property Tax

There is a good chance one is over-assessed when looking at what experts have revealed. For instance, Consumer Reports has published that an error rate of 40% exist in estimating property taxes. The National Taxpayers Union has forwarded a statement that as many as 60% of all homeowners are over-assessed.

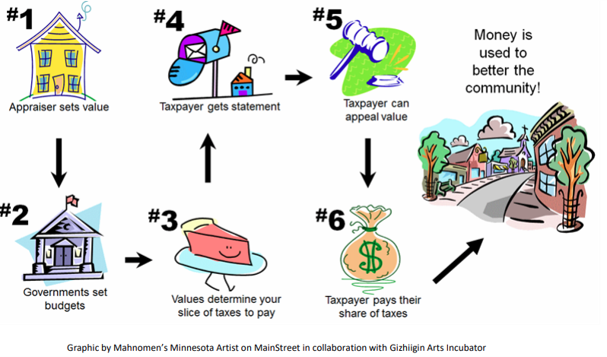

Every town or count conducts a mass blanket appraisal every 8 to 20 years or more in order to appraise the value of real estate property. This way the municipality can fairly distribute the budget overhead from their services to the businesses and homeowners.

The year the blanket appraisal is accomplished, the equalization or sales ratio rate is 100%. Over the years, that ratio changes to reflect the changes in real estate valuations.

Let say 8 years pass from the last blanket assessment. You get a property tax assessment notice saying your assessment is $300,000 for property and home. If the assessment sales ratio for the year is 85%, what the property tax assessor is actually telling you is that they are taxing your home at their estimated worth of $352,940 dollars.

Here is the math: Assessed Valuation ($300,000) DIVIDED by Equalization Rate or Sales Ratio (85% or .85 since need to move decimal over two spaces) EQUALS $352,940 = what the tax assessor says your land and dwelling(s) are worth but not always what it will sell for in the open residential market place.

Assessed Value/Sales Ratio = What they think the market value is and what they will tax you on.

Most people are not aware of the smoke and mirrors that the equalization rate or sales ratio obscures. This is not hard to do, but it brings clarity to the picture. All one needs to do is to call their municipal property tax assessors office to obtain that value for the year they are appealing. That sales ratio or equalization rate might be called by different names such as average ratio, director’s ratio, evaluation level, the home assessment ratio etc. Here, we call it sales ratio.

Reasons To Contest a Property Tax Assessment Appeal

Armed with knowing what the tax assessor thinks your property is worth one needs to do a comparative analysis of sold properties in your local area. As mentioned, we proved you with free access to comparable sold homes in your area for comparison purposes as will as a category adjustment sheet that allows you to fine tune your rough analysis.

If you feel you have a case worth pursing, we are here to help with our training.

Make Your Tax Appeal Come True with Real Estate Valuation and Property Tax Appeal Training

Is lowering a property tax a tough task for you? Real Estate Valuation & Property Tax Appeal Training Course is offering free access to mind map training, property ta adjustment category worksheets and free access to all comparable sold homes in your area.

Were you looking to lower your property tax for a long time? Did you want to know if you had a property tax appeal case worth pursuing?

Your wait is over when you use our free help aids. When you pursue your case and win your appeal, you’ll have extra money to meet many monthly expenses. That might be a possibility when you win your property tax appeal!

Make your dream home come true and check out our free training. Learn if you have a case worth pursuing. It’s a free giveaway provide by our Real Estate Valuation & Property Tax Appeal Training Course. Visit our home page and Contact Us Right Away to see if we can help you.

Click top of page on left title “Property Tax Appeal Training Course” for access.

I received what is called a “Para-Gram” from Self-realization fellowship I wanted to share. It reads:

We cannot live happily by spiritual sustenance alone nor by material prosperity alone. It is only by having ambition and by crowning that ambition with the idea of service to others, either by helping them individually or by working for some great cause, that you will find a spiritual reason for making money for yourself and others. To help others to help themselves also spiritualizes ambition. An Almighty Power has linked us all together. Whenever you help others, you are helping yourself.

Learn More Facts and Details: DIY Property Tax Appeal