Why Property Taxes Need A Second Look

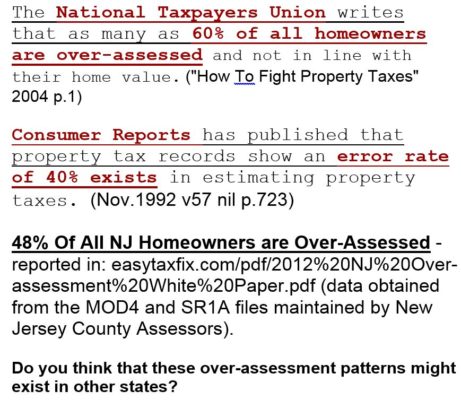

Taxes on our property, our transactions or income exist to support basic community needs in some form or another worldwide. Excessive tax on income or transactions can’t be negotiated. Pay up or go to jail. However, property tax can be negotiated and considering there is a 30% to 60% error rate, it pays to take a good look.

Big Business, Government, Currency and The U.S. Dollar

Many governments run their community efforts and programs intended to help their citizens inefficiently, ours included. They bury their inefficiencies, nepotism, lobbed misappropriations under the rug piling up deficits in their currency.

Our government has defaulted on its debts it seems every 40 or so years. FDR’s 1933 gold confiscation was a bailout of the Federal Reserve Bank; only the government owned the gold. In 1933 owning gold was declared illegal and confiscated by the government. The Great Depression was a default. That bailout set in motion a debt-enslavement syndrome for the U.S. government and its citizens.

In 1971 President Nixon closed the gold window which too was a default. Rigorous wage and price controls were brokered into place anticipating inflation. Since 1971, instead of the Gold Standard, Americans have been on the Dollar Standard.

The world economy is a trade war. Foreign trade worked well for the world as America allowed sellouts and bribes to politicians for favorable trade deals. Other countries and Wall Street profited by enriching the profits for big business.

Big business lobbied deals kept wages in the United States stagnant. Much of the intellectual manufacturing capital was exported to other countries as an exchange for cheap goods sold in Walmart type stores.

The U.S. dollar is the weaponized currency in this trade war. America recently imposing tariffs and sanctions in order to regain some of its lost manufacturing. The idea behind foreign trade is to get raw materials cheaply imported so that one can export manufactured products at a profit.

It’ll be dicey imposing tariffs on steel and aluminum. For example, the cost of producing a beer can will go up for American brewers but unless one imposes tariffs on Heineken, buying German beer in America will be cheaper.

In any case, the U.S. Dollar is backed by nothing. Countries that try to get out of the U.S. dollar are dealt with harshly. Look what Hillary under Obama did to Gadhafi when he announced his country was going on the gold standard and quit selling Libyan oil in U.S. dollars. At the time Gadhafi’s Libya was a model country, trusted ally, Africa’s largest oil producer and a prosperous country.

International trade deals like Trans Pacific Partnership (TPP), North American Free Trade Agreement (NAFTA) are sought to benefit big business by engineered predatory trade deals.To get an idea of this kind of ongoing corruption, Google: Secret Empires: How the American Political Class Hides Corruption ad Enriches Family and Friends.

Most of America’s car industry was shipped to Mexico and much of the manufacturing base sent to China. In return America got cheap cars and consumer goods. As a result our trade partners became dependent on our weaponized U.S. Dollar.

Big corporations and government are not beyond using any means possible to gain their intended results. Little progress appears to take place for a more enlightened understanding so that as human beings, we all are one precious whole. The world could use a protocol where humanity was to be their religion, breath meditation their prayer, empathetic consciousness their god.

Back To Property Tax Market Value

Back To Property Tax Market Value

With property taxes, it’s a problem of sloppy math and human error. The town’s tax assessor does not do the assessing.

A town will hire an appraisal company to do a mass appraisal on a competitive bid. The appraisal company that wins the bid needs to pay those individuals who are going from door to door assigning a market value to the property they are assessing. Too much time looking things over is money lost for the winning bidder.

There is only a minimum amount of time that can be allocated to each home valuation. Often previous valuations are carried over and given an adjustment. Many times those doing the assessing are not experienced appraisers. The appraisal firm winning the competitive bid needs and wants to see a profitable return on their bid. They are going to push their staff to get as much work done in the shortest period of time. Because of this, accuracy is sacrificed.

As a recommendation for maximum real estate exposure in Massachusetts, visit: know about real estate appraisals at MA Real Estate