Market value for a property is not permanent. It fluctuates like the mercury in one’s thermometer; it always is depending on the outside temperature. The overall health of real estate prices are in flux especially in the current overheated economic conditions.

Market value for a property is not permanent. It fluctuates like the mercury in one’s thermometer; it always is depending on the outside temperature. The overall health of real estate prices are in flux especially in the current overheated economic conditions.

Free tax-cut fuel and free money, also known as Quantitative Easing (aka QE) creates massive financial engineering leverage which created this financial bubble. Bubbles burst! It’s only a matter of when (unless the world has been taken over by the central banks). As of this date we are in the longest and greatest sock bubble in U.S. history.

Why Now Is The Best Time To Learn Property Tax Consulting Analysis

As a property tax analyst and consultant your mission is to establish current market value for your client and compare that to the value the tax assessor’s department assigned. When the market goes South, as a property tax consultant analyst, you could be the only hope for property tax relief to over-assessed homes and businesses.

When the span of real estate property taxes for a prospective client differs enough, one has found a case for a property tax appeal. The contingency commission earnings from appealing property taxes is significant. Since the tax savings for your client continue year after year, he is thrilled and your large commission will not matter.

Since this is your business, you set the contingency commission percentage. Some consultants will ask for 80% of the property tax savings won. Another angle is when the commission is split over a 2-years period with a 50% the first year commission and billing another 50% the following year.

For instance, if a home pays a $10,000 in property taxes and you reduced that tax by $2,000, that would result in about $1,600.00 commission if you billed that client at 80% and you’re client can look forward to big tax savings yearly. Look for an average percentage property tax reduction in the 15% to 20% range for most of your cases.

The Future Of The Real Estate Market Predicts Great Changes

The Future Of The Real Estate Market Predicts Great Changes

The future of the real estate market is predictable when one considers cycles. Housing cycle research shows minor peaks in 1854, 1972, 1989 and 2006. These are 17 to 18 year cycles. Baby Boomers who previously pushed the demand for housing are downsizing in their retirement and are dying.

There are not enough people to replace the Baby Boomers whose peak spending years are ancient history. Deflation may soon be on the horizon as interest rates increase and credit tightens.

Home Valuations Fluctuate With Economic Changes In The Market

Deflation leads to lower home valuations. The perceived valuation of a home from a property tax appraiser’s viewpoint may have changed due to changing conditions. It will be smart for your prospective clients to revalue what for many is their primary asset.

America is trillions of dollars in debt, $420,000 for every man, woman and child if you were to assign a numerical reality to this debt that our “public servants” laid on us. The credit bubble will eventually burst and deflation will pervade for a period of time.

This reality of economic boom or bust cycles is good for those who help over-assessed businesses and homeowners. It’s going to be the best of times to be in the property tax consulting business.

The Time Is Ripe For The Property Tax Consulting Business

The Time Is Ripe For The Property Tax Consulting Business

People will be cutting unnecessary expenses in deflationary times. Houses, auto’s and major assets will command less value.

Markets change, technologies that drive the market changes but the rules for establishing a home or businesses market value never changes. Since valuation change, as a property tax consultant analyst, it doesn’t pay to think too differently from what market value actually is. A too high or too low an estimate risks making you look foolish or incompetent.

Assessors Utilize Mass Appraisal Techniques

When a municipality decides to do a mass appraisal they accept bids from mass appraisal companies. The lowest bid wins and that winner will need to make a profit. The faster the job is completed, the more he makes.

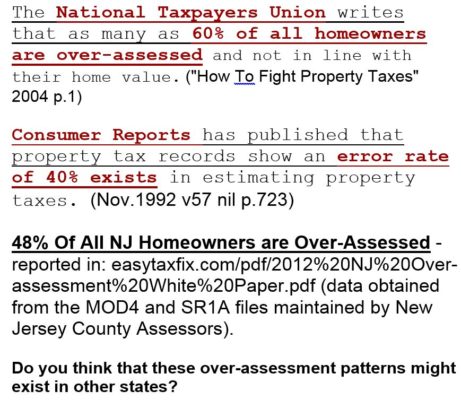

They use neighborhood models and market averages as benchmarks which may not reflect the accuracy of a particular homeowner’s property value. Chances are that that many homes are paying too much in property taxes and need to be reappraised. They should take advantage of saving money on their real estate property taxes by the appeal process.